What is Form 1120-S? A Guide to the US Income Tax Return for S Corporations

S Corps offer tax benefits like pass-through taxation and avoidance of double taxation, but they come with stricter eligibility criteria and shareholder limitations. LLCs, on the other hand, provide more operational flexibility and fewer ownership restrictions, but they may not offer the same level of tax advantages, particularly in avoiding self-employment tax on distributed profits. The choice depends on the specific needs of the business, the tax implications for owners, and the long-term goals of the entity. The IRS pays special attention to S corporation shareholder-employees to deter abuse of that classification. You must pay yourself a reasonable salary before taking tax-advantaged dividends.

The IRS has set stringent eligibility criteria to qualify. These criteria include being a domestic corporation, restricting shareholders to certain entities (such as individuals and specific trusts and estates), and capping the number of shareholders to 100. These requirements ensure that the S Corp status is preserved for smaller, closely held corporations. Compliance with these criteria is critical for corporations aiming to benefit from S Corp taxation. S corporation shareholder-employees must collect a salary, which is subject to FICA taxes. When there’s extra income to distribute, shareholder-employees can receive dividends, which aren’t subject to FICA taxes.

Gain (loss) from disposition of oil, gas, geothermal, or other mineral properties (code I). Report net loss from involuntary conversions due to casualty or theft. The amount for this item is shown on Form 4684, Casualties and Thefts, line 38a or 38b. If any amounts from line 9 are from foreign sources, see the instructions for Schedule K-2 (Form 1120-S) and Schedule K-3 (Form 1120-S). Enter the net section 1231 gain (loss) from Form 4797, line 7.

Quarterly payroll tax return deadlines

Enter cash and credit refunds the corporation made to customers for returned merchandise, rebates, and other allowances made on gross receipts or sales. See Deductions , later, for information on how to report expenses related to tax-exempt income. If the corporation has a foreign address, include the city or town, state or province, country, and foreign how to hold effective nonprofit board meetings postal code. Follow the country’s practice for entering the name of the state or province and postal code.

- If the corporation files Form 941 late with an unpaid tax balance, it faces a 5 percent penalty.

- If there was no change in shareholders or in the relative interest in stock the shareholders owned during the tax year, enter the percentage of total stock owned by each shareholder during the tax year (current year allocation percentage).

- Distributions and other payments by an S corporation to a corporate officer must be treated as wages to the extent the amounts are reasonable compensation for services rendered to the corporation.

- The estimated tax is generally payable in four equal installments.

Ordinary income or loss from a partnership that is a publicly traded partnership isn’t reported on this line. Instead, report the amount separately on line 10 of Schedule K and in box 10 of Schedule K-1 trade payables definition using code ZZ. Solely for purposes of the preceding paragraph, gross income derived in the ordinary course of a trade or business includes (and portfolio income, therefore, doesn’t include) the following types of income.

Filing Requirements: IRS Form 1120S Return for an S Corporation

To be certified as a qualified opportunity fund, the S corporation must file Form 1120-S and attach Form 8996, even if the corporation had no income or expenses to report. If the S corporation is attaching Form 8996, check the “Yes” box and enter the amount from Form 8996, line 15, in the entry space. See Certification as a qualified opportunity fund, earlier. Under an installment agreement, the corporation can pay what it owes in monthly installments.

Steps for Filing S Corporation Taxes

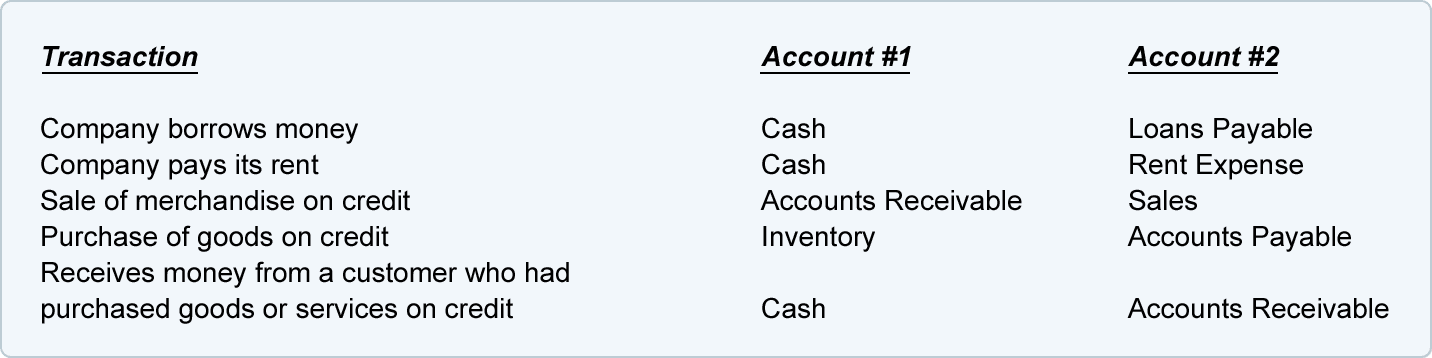

In a world where taxes can be a labyrinthine puzzle, especially for small businesses and corporations, understanding the ins and outs of S corp taxation is crucial. This comprehensive guide delves into the nuances of S Corp taxes, offering clarity and actionable insights for business owners and tax professionals alike. Whether you’re grappling with personal tax returns or corporate tax intricacies, this article provides the essential knowledge needed to navigate the complexities of S Corp taxes effectively. S corporations and other pass-through entities cut out the entity-level tax, passing all income tax liability to the owners, called shareholders. If an S corp has $100,000 in taxable income, all $100,000 gets taxed on the shareholders’ personal income tax returns. S-corporations are required to disclose their gross income on Form 1120-S.

U.S. Income Tax Return for an S Corporation

On the line to the left of the entry space for line 12d, identify the type of deduction. If there is more than one type of deduction, attach a statement what are net assets square business glossary to Form 1120-S that separately identifies the type and amount of each deduction for the following categories. Generally, section 59(e) allows each shareholder to make an election to deduct their pro rata share of the corporation’s otherwise deductible qualified expenditures ratably over 10 years (3 years for circulation expenditures). The deduction is taken beginning with the tax year in which the expenditures were made (or for intangible drilling and development costs, over the 60-month period beginning with the month in which such costs were paid or incurred).